844 LONG TERM CARE PLAN

THE ULTIMATE "844 LTC PLAN" has been updated to the The Return of Premium Long Term Care Plan, learn more HERE.

PHOENIX, AZ – BY DAVID & Todd PHILLIPS, FOUNDER, ESTATE PLANNING SPECIALISTS, LLC

The Answer to Today's Long Term Care Crisis!

You've worked hard to save for retirement and plan for your future. But what would happen if you or someone you love experienced an extended long term care event? Could you cover the impact of unexpected long term care expenses, and which assets would you use to pay for it? Inside this special report is your answer to today’s long term care crisis.

Would you like some extra cash — a LOT of cash — to pay for your (or your parents') long term care expenses?

Medicare covers a woefully small amount of the cost of long term care, and the government knows that. Moreover, our elected officials were so worried about the tidal wave of aging baby boomers that it passed a piece of legislation called the Pension Protection Act, which makes it possible for Americans to pre-pay the costs of long term care for mere dimes on the dollar.

Yes, Dimes on the Dollar using the new, revolutionary and 100% legal "844 Long Term Care Plans."

Don't feel bad if you haven’t heard of "844 LTC Plans" because most investors haven’t. “844 LTC Plans” are largely an unknown IRS-approved financial instrument that allows you to pre-pay for long term care expenses at a highly discounted rate.

The ratios vary, based on your health and age, but every dollar that you deposit into an “844 LTC Plan” will immediately explode by 300%, 400%, 500%, or even more into long term care dollars.

- $25,000 becomes $75,000 to $250,000

- $50,000 become $150,000 to $500,000

- $100,000 becomes $300,000 to $1,000,000

Not only do you pre-pay for care — in either your home, an assisted living facility, or a luxury nursing home — for mere Dimes on the Dollar, your spouse or your heirs, will receive a death benefit that is greater than or equal to your deposit.

Yes, you read that right.

Heads You Win: For every $50,000 you deposit into in an “884 LTC Plan”, if you trigger the LTC provision, depending on your age, you will receive $150,000, $200,000, $400,000 or more in long term care dollars for you to spend however you see fit, be it in your own home or in an assisted living or nursing home.

Tails You Win: Although the odds are extremely high (in the 70% range) that most of us will require long term care, we all hope that we don’t. If you don’t, your spouse or your heirs will receive up to or greater than your “844 LTC Plan” total deposit.

Moreover, both the dollars used to pay for your long term care OR the dollars that are passed on to your heirs are 100% income tax free!

Sounds great, doesn’t it? Well, it is but you need to decide quickly if an “844 LTC Plan” is right for you, so let me give you the complete details so you can make an intelligent decision.

Hi, my name is David Phillips, and I’ve been helping people plan their estates for over four decades, and I want to encourage you to take a long, serious look at “844 LTC Plans” before it is too late.

Too late?

With a $20 trillion national debt and exploding budget deficits, President Trump and Congress are aggressively looking for new ways to balance the budget and “844 pre-paid LTC Plans” are so good they may soon go the way of the dinosaur.

Of course, you shouldn’t invest in anything that isn’t appropriate for your personal situation, so let me tell you more.

One of the principles of public policy is to penalize people for doing things that aren’t good for them — such as ‘sin’ taxes on cigarettes and liquor — while rewarding people for doing things that are good for them, like savings for their children’s college education with 529 plans or saving for retirement through a 401(k).

401(k)s have become the cornerstone of many Americans retirement plans, but the creation of 401(k)s was almost an accident and the name came from the tiny section of the tax code that created it.

Modern 401(k) plans were not an intentional design of the U.S. Government or the Internal Revenue Service. 401(k)s were the creation of some savvy lawyers and accountants that seized upon a loophole in the Revenue Act of 1979. In fact, the federal government twice tried to invalidate 401(k) plans in the late 1980's over concerns that tax receipts would fall too fast as more workers funded their own retirement plans.

Fortunately, the public outcry to preserve 401(k)s was so strong that the IRS caved in, and the rest is 401(k) history.

The same life-changing financial scenario is playing out today in the form of “844 LTC Plans” thanks to the Pension Protection Act.

Everybody knows an Evelyn. The Evelyn I knew was 72 years old but looked and acted like she was years younger. Evelyn was so healthy, active and happy that her smile was only dwarfed by her zest to live the ultimate retirement. Heck, she could have been a poster girl for AARP.

Everybody knows an Evelyn. The Evelyn I knew was 72 years old but looked and acted like she was years younger. Evelyn was so healthy, active and happy that her smile was only dwarfed by her zest to live the ultimate retirement. Heck, she could have been a poster girl for AARP.

After a long career in education, Evelyn retired and focused her attention on her previously dormant passions; travel, yoga, putzing around her garden, volunteer teaching, and reconnecting with dear friends and family.

Evelyn was living what most would call the perfect retirement. Nobody goes into education to get rich, but Evelyn led a simple, thoughtful life and made all the right financial moves; maximized her pre-tax 403b (the education equivalent of a 401k), avoided credit card debt, made significant progress at paying off her mortgage and had excellent health insurance.

Evelyn had planned for everything…or so she thought…but I am sad to say that she recently suffered a serious, debilitating stroke that forced her family to move her into a long term care facility.

Evelyn’s tale is a true story, but I’ve changed her name for privacy. However, hundreds of thousands of Americans face similar types of health curveballs every year, so I can be easily talking about Joan or James, or Judy and Joe.

If we had a magic wand, we’d all peacefully die in our sleep on our 93rd birthday after living an invigorating life. That way we’d never have to be a burden on our children or spend a fortune on the last few years of our lives in an assisted living facility or a nursing home.

According to poll after poll, the biggest fear American retiree’s have, is that their health will fail, they’ll get stuck in a costly long term care facility, run out of money, and die destitute and alone in a nursing home.

In fact, today more than ever, as baby boomers deal with the care of their parents and loved ones, the topic of providing for their own care has catapulted to the top of the list of concerns.

Evelyn had a six-figure retirement account, but she had one vulnerability that could have wiped out all her life savings.

No, I’m not talking about a bear market or inflation, but the high cost of long term care. An event that could have quickly burned through her retirement savings.

Evelyn had a son, a successful dentist, and the two of them set aside a reserve fund in what I call the Ultimate “844 LTC Plan” which provides the means to pay for her long term care medical expenses, without dipping into her assets, even if she wants to reside in a hotel-like care facility.

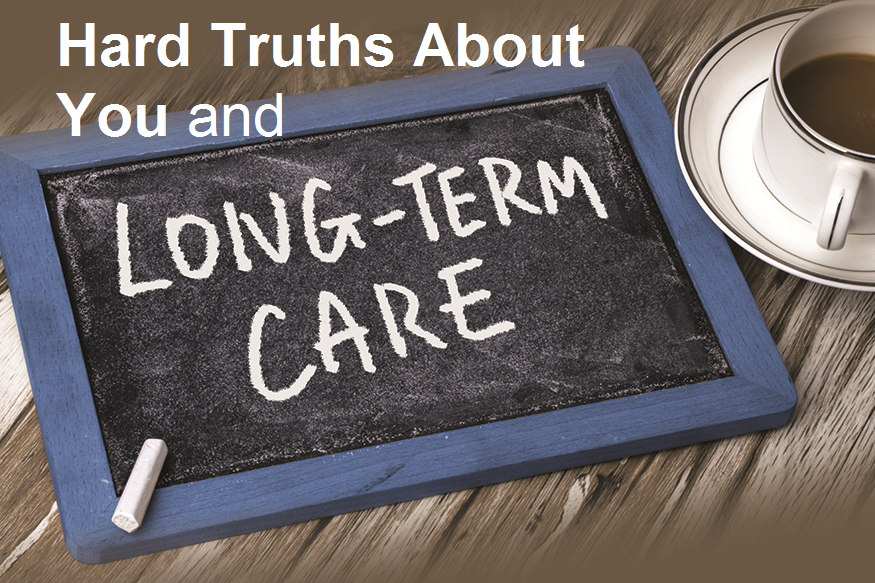

You don’t need to panic, but you do need to know the hard truths about the current long term care crisis:

- If you are 65 years or older, there is a 72% chance that you will require some type of long term medical care in your lifetime.

- Moreover, if you’re a woman, the odds get even worse; 8 out of 10 women will need long term care.

- And if you’re married and over 65, there is a 91% chance that one of you will experience a long term care event according to the USA Today.

- Warning; long term care isn’t cheap! The national average cost for a Nursing Home Private Room in 2016 was $102,696. This is just the average costs, with average accommodations. The average cost for a private room in Alaska is over $290,000 per year! The average cost for a full-time, in-home registered nurse is a whopping $152,002 ($416.46 a day).

- Long term care costs add up fast. It’s estimated that an unexpected long term care event will cause us to burn through our retirement assets 2 to 3 times faster than expected.

- Approximately 80% of individuals who need long term care receive services in their own home by unpaid family caregivers.

- Caregiving involves lifting, bathing, and toileting which can take an emotional and physical toll. It’s no wonder a spouse caring for their disabled spouse is 6 times more likely to suffer from anxiety or depression.

And no, you cannot count on the government to come to your rescue. It’s an unfortunate myth that more than 50% of American’s believe Medicare and Medicaid will cover their long term care expenses. Truth is, only a small portion is covered through Parts A/B and G of Medicare for the first 100 days. After that you have to spend down ALL OF YOUR ASSETS to qualify for Medicaid.

We can read all of the scare statistics, but the truth is, it is going to happen to you, to me and to others we know. So what are your options? The reality is that you need to take one of three steps to protect yourself against the exorbitant cost of a Long Term Care event.

Buying Long Term Care Insurance

The premise behind long term care insurance is like any other insurance. In exchange for annual premium payment, an insurance company promises to pay a pre-specified amount in long term care benefits.

Long term care insurance is expensive. Very expensive. A typical premium for a 65-year old couple would be more than $4,500 a year for a 5-year, $5,000 a month long term care benefit with a 90-day waiting period. Add in inflation riders and the premium could easily shoot past $11,000 a year.

Qualifying for coverage isn’t easy. It is estimated that only 25% of the people who apply for long term care insurance are accepted. Anyone with pre-existing health issues, like high cholesterol or hypertension, would faint at the sky-high cost of coverage or be denied from the get-go.

Those already expensive premiums can go even higher. That $4,500 annual premium that our 65-year old couple is paying isn’t guaranteed. In fact, long term care premiums are skyrocketing.

Why?

Long term care insurance companies have two sources of revenues: premiums and returns on the investments those premiums are invested in.

Insurance companies typically invest only in super-safe bonds, and because of today’s low interest rates, their investment returns are minuscule. Moreover, insurance companies have grossly underestimated the cost of claims and are paying out more in benefits than they anticipated.

The result is that 90% of long term care insurers have abandoned the business. Those that have stuck around have raised premiums on older policies.

In 2016, some long term care policyholders were hit with enormous premium increases. For example, the largest seller of long term care policies to U.S. residents, raised premiums by 80% to 130% depending on the state of the insureds.

No wonder consumers are steering clear of traditional long term care insurance. In 2000, 700,000 Americans purchased long term care insurance. By 2017, new purchases had dropped to only 40,000.

Use It or Lose It!

Not only is there zero guarantee that the cost of a standalone long term care policy won’t increase, don’t forget that it is a “use it or lose it” contract.

Just like homeowners’ insurance; if your house doesn’t burn down… you don’t get paid. Likewise, if you’re lucky enough to make it through life without needing long term care, all those tens of thousands of dollars of premiums you paid will be for nothing.

If you are one of the fortunate 28% that don’t experience a long term medical event, the insurance company doesn’t send back the premiums you’ve paid over the years after your death. Heck, the insurance company is delighted that you died before they had to pay.

His Name was Edward…

A True Story

Edward was a hard-working, successful businessman. He founded a company that built and sold high-end custom pool tables that were so beautiful and well-built that many of them still grace homes in Northern California today.

Edward fell in love with a young woman named Elaine. They were one of the fortunate couples that not only celebrated a Golden Anniversary, but even made it to that rare 60th wedding anniversary.

That was a marriage that almost didn’t happen. Edward volunteered to join the Navy out of high school, but due to his poor eyesight was disqualified from front-line service. Instead he worked as an orderly in a Utah Army hospital. In fact, Edward was the only member of his high school gymnastics team that didn’t join the Navy in July 1941. Tragically, all of his teammates were killed at Pearl Harbor aboard the U.S.S. Arizona. Edward’s life was spared.

After uttering his first words to her in June of 1944, “Well where have you been all my life?” Edward and Elaine eloped and were married just one month later in July.

After the war, his marriage and business thrived. Despite his busy professional demands, he went to church every Sunday without fail and made sure that all three of his rambunctious sons went as well. I am proud to say that I was the second of those three rambunctious children, and my son Todd was his first grandchild. Yes, Edward was my father and I am sorry to tell you that he died on August 17, 2005. Edward had a wonderful life but the last few years were challenging. The reason I’m telling you this story is so you and your family don’t have to face the same problems my parents did.

In the late 80’s, predicting the huge impact long term medical expenses would have on the World War II generation, some insurance companies got creative and designed Long Term Care Insurance. Being a believer in the concept of Long Term Care Insurance, I purchased one of the first plans for both of my parents, Edward and Elaine.

In 1999 my father was diagnosed with Alzheimer’s, and while we were all extremely distraught over the news, we were comforted knowing that there was a long term care policy in place.

We sold the Sacramento, California family home of 40 years and moved my parents closer to my brother and I in Arizona. This way our families could help take care of him if needed. As is usually the case with the disease, my dad progressively got worse. Over the next four years, my mother doted on Dad and was the primary care giver, spending nearly every waking moment as his aid. Both our families helped for as long as we could. It wasn’t until the last year of his life that Hospice Inspiris came to their home for four hours a day, twice a week.

The hospice caregivers were angels and Mom was able to leave dad’s side with the confidence that he was in good hands. They would bathe, dress and feed him. What a blessing that was. Even though my father was eventually incapable of performing any of the normal activities of daily living, he never qualified for any benefits from the long term care policy I bought him.

Why not? To qualify, my father had to be admitted into a nursing home as a permanent resident. No one really wanted that, especially Mom. My dad peacefully passed away after only being in an assisted living facility for one week, not a nursing home. Even though I had paid all his premiums for years and my father was suffering from Alzheimer’s, his long term care benefits were never triggered and his policy never paid out a dime of benefits. The thousands of dollars I paid were gone! Granted, with dad’s policy we had purchased some peace of mind, but financially we lost the bet. To finish the story, my mom is 91, still going strong and for that I feel very blessed.

Be Rich Enough to Pay for Everything (Self Fund)

If you have sufficient assets, you can always self-fund your long term care costs. In short, pay for everything out of your own pocket.

The appeal of self-funding is that you don’t have to pay premiums to any insurance company and you only pay for services that you need.

However, as we all know, long term care expenses can add up fast and can easily gobble up over $100,000 a year, based on today’s dollar. Tomorrow, the only fact we know is that care cost will escalate to unprecedented numbers.

That is why most people who choose to self-fund their long term care, need to set aside a separate fund to pay for long term care expenses.

Since this money needs to be liquid, it should be invested in safe money vehicles, and not be subject to market risks. The money needs to be readily available.

The problem with readily available also means low yielding. And in today’s extremely low interest rate environment, that means you’ll be lucky to make 1% on this long term care reserve fund.

Of course, self-funding requires that you set aside a sufficient amount of money — generally several hundred thousands of dollars — to cover expenses.

Remember, however, that should you self fund, the money you set aside will ONLY be worth what it is worth when being used for long term medical care. In other words, $100,000 is $100,000.

Also, don’t forget to include taxes in your self-funding calculations, especially if you plan to use qualified funds such as IRA’s. $100,000 withdrawn from an IRA, assuming 28% tax rate, would only yield $72,000 net for your long term care expenditures.

The Best. By Far.

“The Ultimate 844 LTC Plan”

A better option is the “Ultimate 844 LTC Plan”, in which you reposition your self-funded dollars from your left pocket to your right pocket, creating an account that grows up to 3,4,5, even as high as 10 times should you experience a long term care event.

That’s right; $100,000 of cash can increase up to $1 million of long term care coverage!

Moreover, if you have the good fortune of dodging the long term care bullet, a tax-free life insurance benefit valued equal to your deposit, or more will be paid to your beneficiaries at your passing.

Here’s how it works:

The “Ultimate 844 LTC Plan” is an insurance contract that includes an IRS-approved long term care benefit that allows you to access the contract value to pay for qualifying long term care expenses.

Example #1: Two 65 year old sisters, Jane and Joan, have each set aside $100,000 to cover future long term care expenses.

Jane puts her money into a CD while Joan deposits her $100,000 in the Ultimate “844 LTC Plan.”

Ten years later while hiking in Sedona, Arizona they are both struck by lightning and the sisters sustain injuries that prevent them from performing 2 of the 6 Activities of Daily Living.

The CDs that Jane invested in grew (assuming a 1.4% net return) to $115,370, after taxes, and would pay for roughly 24 months of long term care at $4,750 a month. After 24 months, Jane would have exhausted all her capital.

Joan also needs long term care, but her “Ultimate 844 LTC Plan” provides $5,739 a month for 72 months or $448,872 of total benefits, (4 ½ times her initial transfer deposit). All tax free, by the way!

After exhausting all her money, Jane was forced to shed all her assets, go on Medicaid, finishing out her days in a crowded, no-frills nursing home. Meanwhile, Joan was able to enjoy bingo night at her granite counter topped resort-like care facility for the next six years and was even able to stash away some leftover cash for her grandchildren’s birthdays.

If you have dollars sitting in low-yielding certificates of deposit (CDs), Treasuries, or money market funds, the “Ultimate 844 LTC Plan” is the perfect place to park your dollars. With the “Ultimate 844 LTC Plan”, you transfer a lump sum that creates a fully paid-up life insurance policy with an instant multiplication of that lump sum into a long term care benefit.

You receive a monthly TAX FREE long term care benefit each month once you are unable to perform 2 of the 6 Activities of Daily Living: Bathing, Continence, Dressing, Eating, Toileting and Transferring or have cognitive impairment, such as dementia or Alzheimer.

Example #2: John, age 65, is in moderately good health and transfers $100,000 from a CD he is currently earning less than 1% per year, into the “Ultimate 844 LTC Plan” and selects the 5% annual compound inflation benefit... Here’s what happens to his money over the next 25 years.

Benefit #1: John’s initial monthly care benefit would be $3,394, or a total pool of $321,096. At the time of application he chose to receive his tax-free Cash Indemnity payment for 6 years. Because he also selected the 5% compound inflation option, his monthly payment will actually increase through the years. For example, should John trigger a claim in 10 years his monthly benefit will have increased to $6,103 and will continue to grow each year based on the mathematical calculation of compounding the initial benefit by 5% annually. Should John begin his claim at age 80 his initial monthly payment will have grown to $7,789. Because of the 5% compounding factor his total 6 year LTC pool of cash will be a whooping $635,747, over 6 times his initial deposit.

John’s 844 LTC Plan after tax internal rate of return (IRR) at age 80 will be 11.54%. Meaning that, assuming a 25% tax rate, he would have to earn 15.38% before tax, each year for 15 years, to equal the IRR he will earn in his 844 LTC Plan. Considering this amazing IRR is totally guaranteed, it just can’t be duplicated year after year in ANY other financial instrument.

Benefit #2: At the foundation of the 844 LTC Plan is a Universal Life policy. This is the overriding characteristic that affords the Tax-Free LTC benefit payouts, as stipulated in section 844 of the Pension Protection Act. John’s life insurance benefit in 5 years will be $104,228, more than the initial $100,000 he transferred from his CD.

Benefit #3: If John needs his deposit back for an unforeseen event, he is guaranteed to receive 100% of it back after five years. And don’t forget that he enjoyed five years of valuable long term care protection.

Indemnity vs. Reimbursement

I want to point out a key feature of the “Ultimate 844 LTC Plan” that most consumers overlook.

Corporate lawyers are notorious for making things more complicated than they need to, but there is one crucial clause that you absolutely must have. I’m talking about cash Indemnity benefits versus reimbursement benefits.

Cash Indemnity is when the dollars are paid to YOU for YOU to use as you see fit. Example, if you need in-home care and are eligible for a payout of $5,000 per month but only incur $1,000 of care, fantastic, you can pocket the extra $4,000 and use it for anything whatsoever. Even use it to fly your kids across the country to visit you.

Reimbursement is exactly like it sounds. If you incur $1,000 of care costs, you need to submit the receipts to the insurance company and wait for them to reimburse you!

My father had a traditional long term care insurance policy that operated on a reimbursement basis. He needed in-home care, but the insurance company refused to pay any benefits because it didn’t cover in-home care.

What Could Go Wrong?

As I said above, the biggest risk is that this fantastic option disappears for those who don’t take advantage of it soon. There are, of course, always risk factors, just like any investment. The risk with any “844 LTC Plan,” like any insurance policy, is quite small, but you want to make sure that the company has the ability to pay the claims.

In the case of all “844 Plans”, insurance companies are required by state law to keep cash and securities liquid to pay benefits on their policies. Thus, the risk with companies in this business is quite low.

Second, you can check out the claims-paying abilities of any insurance company by looking at their financial ratings provided by rating agencies such as Standard & Poor’s or A.M. Best. I recommend you stick with only the highest rated insurance companies, at least A- or better with A.M. Best, and a COMDEX Score of at least 90!

Since financial strength was my #1 requirement, I am pleased to tell you that the “Ultimate 844 LTC Plan” we have selected is issued by one of the oldest (more than 100 years in operation) insurance companies in America and also, one of the financially strongest insurance companies in the world (A+ rated, 95 COMDEX).

Think about it; there are only 4 potential scenarios for all of us:

1. We live a long, healthy life and never need assisted living/nursing home care.

All of us wish to live a spry, healthy life into our 90s and die peacefully in our sleep without triggering an LTC claim. That’s the dream scenario for all of us. If you’re lucky to fall into this category, with the “Ultimate 844 Plan” your heirs will receive at least 100% of your deposit from a life insurance benefit.

2. We die younger than we expect, and never need care or enter an assisted living/nursing home.

Never entering a nursing home sounds great but dying early isn’t what we had planned either. However, just like in scenario #1, with the “Ultimate 844 Plan”, your heirs will receive a tax-free inheritance that can be greater than or equal to your original deposit.

3. We develop health issues and require long term care that lasts for several years…and then we die.

For most Americans, this is our #1 retirement concern. When triggered, Your “Ultimate 844 LTC Plan” will pay you thousands of dollars each month to cover the level of care you choose. None of us want to spend our final years in a care facility or receiving medical care, but if you do, your “Ultimate 844 LTC Plan” will make sure you can afford it and not wipe out a lifetime of savings.

4. We develop health issues and require long term care that lasts for only a few months…and then we die.

You may be lucky and only need care for a short period of time. In this case, your heirs will still receive a 100% tax-free inheritance from the life insurance portion your “Ultimate 844 LTC Plan.” You just won’t have collected the full bounty of the long term care cash payments.

Here’s the bottom line, you come out a big winner in 3 of the 4 above scenarios but only get a little more than your original investment back in scenario #4.

In anybody’s book, that is a pretty darn good outcome and why the “Ultimate 844 LTC Plan” is an estate planning tool that should be in every estate plan going forward.

Questions? Call 1-888-892-1102

(Be sure to mention promo code: 844LTC)

Frequent Asked Questions (FAQs)

Question #1: Do I need to take a medical exam to qualify for the “Ultimate 844 LTC Plan?”

ANSWER: Nope! A medical exam is not required! Instead you just answer a few medical questions, and take a cognitive impairment test over the phone. For the most part, if you aren’t being treated for a major illness or don’t have dementia or Alzheimer’s…you can secure the “Ultimate 844 LTC Plan.”

Question #2: Do I have to enter a nursing home to collect benefits? Can I access my multiplied benefit to pay for in-home care?

ANSWER: Hey, these are your dollars after all, you can use them however you see fit, whether that be in a traditional nursing home, an assisted living facility, or even for in-home care.

Question #3: How hard is it to trigger the tax free long term care benefits?

ANSWER: All you need is a note from your doctor that states you cannot perform 2 out of the 6 Activities of Daily Living without assistance or that you have cognitive impairment.

The six ADL’s are:

- Bathing

- Continence

- Dressing

- Eating

- Transferring

- Toileting

Question #4: The Ultimate 844 LTC Plan 29 Question #4: For how many months will I receive a payment from my “Ultimate 844 LTC Plan?”

ANSWER: After a 90 day waiting period, you will receive a monthly payment for up to the term of your selected benefit period, which can be as long as 84 months. Most clients select the 72 month benefit payment plan.

Question #5: What about inflation? Can I pick my inflation factor?

ANSWER: Yes. We will help you find the sweet spot specific to your goals and objectives. You can choose a fixed, pre-determined monthly benefit, or an inflation-adjusted payment to make sure that inflation doesn’t erode your purchasing power. The inflation options are 3% simple or compound and 5% simple or compound.

Question #6: Are you 100% sure I can use this for in-home care, and can my family or friends be counted as my caregivers?

ANSWER: Yes! Your “Ultimate 844 LTC Plan” can be used for a wide variety of care, including informal care from family and/or friends. Here’s a list of just some of the uses of care:

- Home Health Care Household Services

- Caregiver Training

- Adult day care

- Home modifications

- Assisted Living

- Nursing Home Care

- Respite Care

- Hospice

- Benefits outside the U.S.

In short, you can access the dollars from your “Ultimate 844 LTC Plan” to pay for anything. After a 90 calendar day elimination period, your full monthly LTC benefits will be sent to you.

Question #7: Is there a minimum and maximum issue age?

ANSWER: Anybody over the age of 40 should consider the “Ultimate 844 LTC Plan”, but the maximum issue age is 75. We do have alternative plans if you are older than 75, so please call for details, 1-888-892-1102.

Question #8: What is the minimum and maximum dollar amount I can transfer into the “Ultimate 844 LTC Plan?”

ANSWER: The minimum deposit is an amount that produces a $50,000 life insurance death benefit. Depending on your age, the duration of care and the inflation option you select, your premium deposit could be as low as $20,000. The maximum deposit is $500,000. Most people reposition between $75,000 to $300,000.

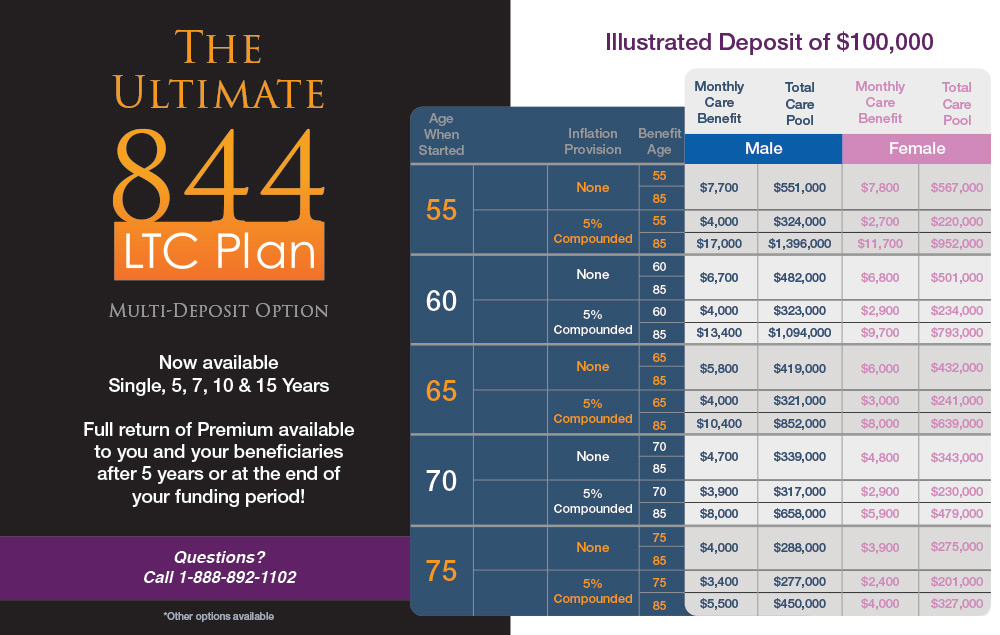

Question #9: Can I choose to spread my premium deposits over the years or do I have to make a single sum premium deposit transfer?

ANSWER: While you receive a substantial discount for making a single sum premium deposit, for those that have illiquid or qualified assets such as an IRA, or for those that want their assets in the market, the multi-deposit options are viable alternatives. You can choose between 1, 5, 7, 10 and 15 years premium deposit options. The key is that you take advantage of the overall leverage that The 844 Plan generates so that you don’t have to spend your hard earn assets to pay for the exorbitant costs of a long term care event.

Question #10: Who should NOT consider the “Ultimate 844 LTC Plan?”

ANSWER: The plan is not suitable for:

- Those under 40 and over the age of 75

- Anyone with serious health issues, such as cancer, COPD, or Alzheimer’s

- Anyone with a net worth of less than $250,000

Question #11: How do I know my money will be there when I need it?

ANSWER: Financial strength was our #1 requirement when choosing a carrier. The “Ultimate 844 LTC Plan” is issued by one of the oldest and strongest insurance companies in the world (A+ rated, 95 COMDEX).

What to Do Next…

At the beginning of this report, I asked you if would you like some extra cash — a LOT of cash — to pay for long term care expenses and that unless you are really poor or really sick, you absolutely should take a good look at the “Ultimate 844 LTC Plan.” I also told you to do so quickly before Congress takes away this fantastic retirement planning tool.

Remember, we’ve done all the homework for you, and we know who offers the best “844 Plans” in the country. That’s why we have continuously been recommended by financial gurus like Mark Skousen, Bob Carlson, Tony Sagami, Dr. David Eifrig. Some for as long as 30 years.

There are several “844 LTC Plans,” but the features and benefits vary widely from company to company, so don’t make a move without talking to me, my son, Todd, or someone from my staff first. Look, if you’re old enough to quality for AARP, you most likely have some low-yielding savings set aside, and the high cost of long term care worries you… I urge you to transfer a portion of your assets into the “Ultimate 844 LTC Plan.”

You’ve used other people’s money to buy your house, your car and maybe even start a business. Why not reposition a few dimes today from your portfolio to create guaranteed dollars for tomorrow?

Qualifying is easy — really easy — if you’re relatively healthy. The application can be done by traditional mail or completed online. And unlike the traditional long term care insurance policies that require a full underwriting process, approval is usually within 4 days, after a phone interview.

Give me just 5 minutes of your time below and I’ll show you how you can save up to 90% on your long term care expenses.

Complete the Analysis Request form below and I will send you a detailed outline of the best “Ultimate 844 LTC Plan” based on your personal goals. No hassles, no obligation, no pressure... I promise!

As always, feel free to call me or someone from our staff at 1-888-892-1102 or e-mail us at This email address is being protected from spambots. You need JavaScript enabled to view it. or This email address is being protected from spambots. You need JavaScript enabled to view it.. Be sure to mention promo code: 844LTC.

David T. Phillips

CEO, Estate Planning Specialists

THE ULTIMATE "844 LTC PLAN"

Free, No-Obligation Analysis Request Form

Request your 844 LTC Analysis

*CONFIDENTIALITY GUARANTEE: We do not share your personal information with anyone.