President Joe Biden’s tax proposals threaten the preferential treatment rich Americans get on their income, investments, and inheritance, prompting the wealthy to adjust their finances before the tax changes can take effect.

“People have been thinking about this since there was a possibility that Joe Biden would be elected president,” Lewis Taub, a certified public accountant and New York director of tax services at Berkowitz Pollack Brant Advisors, told Yahoo Money. “I’ve been discussing this with clients since October or November of 2020.”

Biden’s plan targets some of the biggest advantages in the tax code that wealthy Americans utilize, especially the treatment of capital gains — a big source of their income that’s taxed at a lower rate than wage income, which is the main source of income for the bottom 99% of Americans.

“High net worth individuals worry about two things,” Taub said. “They’re worried about capital gains, and they’re worried about their estate planning plus timing of their gifts.”

‘Plan on an annual basis’

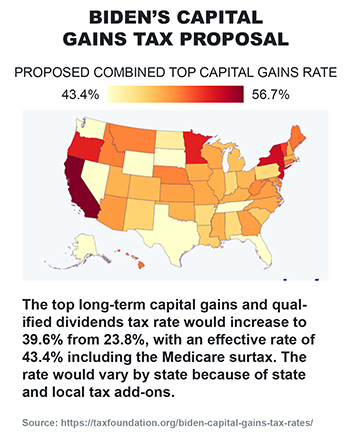

Biden’s plan nearly doubles the base top long-term capital gains rate, increasing the effective rate to 43.4%, including the Medicare surcharge.

If implemented, the new capital gains rate would be at its highest level in almost 100 years, according to the Tax Foundation. That could be costly for the top 1% — capital income accounted for 41% of their income in 2016, according to data from the Congressional Budget Office.

The 43.4% rate would apply to those earning over $1 million. But some high-income earners may get under that threshold with advanced planning, allowing them to pay the next lowest rate of 23.8%. basis to keep your overall income underneath that $1 million, just so you don’t have to pay extra tax on capital gains,” Karl Schwartz, CFP and CPA, at Team Hewins, a wealth management company that works with high net worth individuals, told Yahoo Money.

For instance, those selling a business could choose an installment sale that spreads the income from the sale over time, keeping them in a lower income tax bracket.

The potential tax changes likely would go into effect in 2022, according to Taub, giving wealthy Americans until the end of the year to review their portfolios and income sources. Investors who are looking into selling stocks may do it before the potential tax hikes kick in.

“There is an acceleration of gains, there’s an acceleration of income,” Taub said. “If you’re thinking of selling something in the not too distant future, you might want to do it in 2021 as opposed to 2022, because the tax would probably be less in 2021.” “There is an acceleration of gains, there’s an acceleration of income,” Taub said. “If you’re thinking of selling something in the not too distant future, you might want to do it in 2021 as opposed to 2022, because the tax would probably be less in 2021.”

Biden’s plan includes restoring the top individual income rate to 39.6% for taxable incomes above $400,000. Many close to that threshold may accelerate income into 2021, according to Taub, such as converting traditional IRAs to Roth IRAs or exercising stock options. Deferring deductions to 2022 also can lower taxable income for high net worth individuals.

‘Zero gain’

Current tax law allows heirs to inherit stocks, real estate, and other assets that the deceased owned without paying tax on the gains in value — called the step-up basis. This can effectively tax-exempt an investor’s lifetime capital gains when inherited by an heir.

“People are always astounded when I tell them,” Jules Martin Haas, a New York-based estate planning lawyer, told Yahoo Money. “They say ‘Is there any tax on this?’ No, you’re selling it at fair market value. You sell it with the value that it has today. Zero gain.”

But Biden’s plan would eliminate the step-up basis, meaning the rich would pay capital gains tax on inheritance. But Biden’s plan would eliminate the step-up basis, meaning the rich would pay capital gains tax on inheritance.

To soften the blow, wealthy Americans are looking to life insurance. If the life insurance policy is held in an irrevocable life insurance trust, the death benefit from the policy would not be included in the estate, meaning the amount of estate tax or capital gains tax that would be due on death would not be increased.

“This is a huge change,” Inna Fershteyn,a New York-based estate planning lawyer, told Yahoo Money. “There’s not much you can do ahead of time, other than buy life insurance… there is nothing you can do in terms of moving new assets around to avoid this.” |

|