Shelter from the Storm - What to do now!

By David Phillips

I think the Wicked Witch of the West said it best as she was melting: “Oh what a world, what a world!”

The events of the past few weeks have been nothing short of a tumultuous tornado. The kind that sucks houses from their foundations and sends them into the unknown.

I firmly believe that Covid 19 virus will run its’ course in the U.S. and be another flu that we will, at our option, be vaccinated for. The destruction that it will leave in its’ wake, however, is still yet to be seen. If the market is any indication of what is to come, there is only uncertainty for certain. But in reality, is that any different that what we have been expecting all along? The market has been on a bull run for 11 years, with only a minor dip or two through those years. Most every financial guru has been predicting a decline, a major correction. Well, it’s happening.

Dr. Mark Skousen, editor of Forecasts & Strategies recently stated in a Special Report he published in January: “You need to move to safety now well before the big event. Stock prices always move based on the risk of what will happen in the future. And if the risk is there, we’ll see people starting to sell.”

Unfortunately it took a virus that we knew was coming since September to cause the Dow to lose more in one day than it ever has, to then rebound on Friday to gain back more than it ever has in a single day, and then to drop like a ton of bricks on Monday. What a ride!

So what are we to do? Dr. Skousen further stated in his report that: “now is the time to take some chips off the table. I am suggesting that you move your ‘can’t afford to lose money’ out of the stock market and into a different type of retirement account. I call it the Secure Retirement Account or an SRA. An SRA is essentially a 100% principle protected stock market investment with two basic important safety rules:

- Your principal is 100% protected. It cannot drop no matter what happens with stocks. So, for example, in 2008 stocks were down -35.6%. An SRA? It would have enjoyed no loss!

- If stocks go up, unlike cash, you still get to access the upside. And in fact, sometimes with the upside only gain, you can actually earn MORE than stocks. For example, from January 1, 2000 to January 1, 2019, the SRA would have performed better than the S&P 500 for that same time period.

“When you compare an SRA to other 100% protected investments – like CDs or a savings account – the results aren’t even close. Since January 1, 2008….a Secure Retirement Account produced 489% greater returns than a savings account and 176% more profit than U.S. Treasuries.”

Any way you look at it, it is the ultimate safe investment.”

We totally agree. No matter where you are today. No matter where your “at risk investments” are at the time you are reading this, you absolutely need to move some of your money into a “storm cellar.” Chances are that you won’t die from the Corona Virus, but there is a chance that your 401k will become a 201k, if it already hasn’t. I mean when they cancel the Sweet 16 NCAA Tournament and all the related revenue is lost forever, you know it is going to impact the markets.

So what does Dr. Skousen mean when he says “take some chips off the table and transfer them to a Secure Retirement Account?” What is an SRA? Plain and simple it is an Indexed Annuity, an Indexed Universal Life Insurance policy or a combination of both. Let me explain the “safe shelter” game plan for these tumultuous times:

Defensive Strategy #1: Move a sizeable portion of your “at risk” money into an Indexed Annuity.

There are literally hundreds of Indexed Annuities available today. They all have a 0%, no loss provision that assures your account won’t lose due to market collapse. What separates the wheat from the chaff, is how much upside exposure and potential interest you can make when the market recovers.

Most insurers have already moved their upside exposure over the last few weeks when the 10-Year Treasury Note dropped below 1%. For example, one of our most popular Indexed Annuities just dropped, giving 40% of the S&P 500 participation in up years to only 15% effective March 18th.

As it stands, if you are under 80, we’re finding Delaware Life’s Stages 7 to be one of the most competitive options. They are still giving 42% participation on the S&P 500, so assuming the market rebounds and is up 20%, you would make 20% x 42% = 8.4%. If the market tanks, you’ll get 0% for the year. Worst case is you’ll make what the Treasuries are paying, 0%. Best case, the market rebounds and you get 42% of whatever it does.

Another great option offered in the Stages 7 is their Morgan Stanley Global Opportunities Index. This Index is an all-weather Index designed to produce positive have made 8.82%. Since there is no downside, if the market doesn’t rebound you wouldn’t have lost a dime this year and would have been able to retain all of your earnings from previous years.

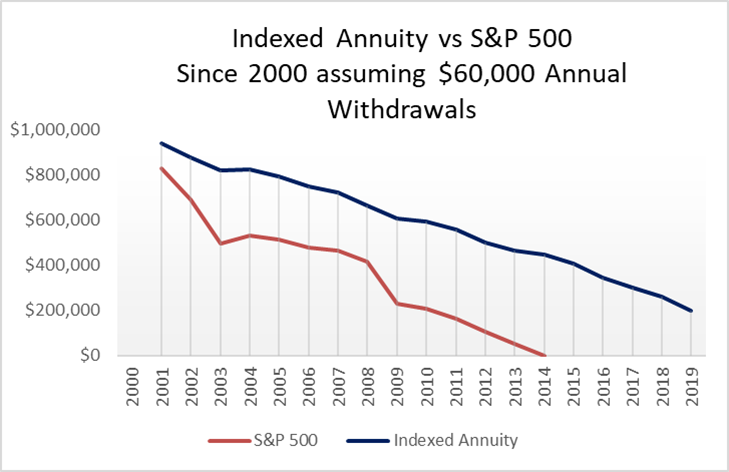

Think this is no big deal? It might not be if you aren’t withdrawing money for retirement and you have the luxury and time to wait for a recovery. But if you are withdrawing money, further declines would greatly affect your retirement. Consider the difference in the following graph:

If you had $1,000,000 in 2000 and assume you had all of your money in the S&P 500 (dividends not included) and took just 6% out ($60,000 per year), you would have run out of money by 2014. Assuming you invested in an Indexed Annuity with 40% participation on the S&P 500 in the good years and 0% in the down, you would still have $154,017 left in the tank. Zero is your Hero!

Complete the Secure Retirement Account Analysis Request Form below or call my son Todd at 1.888.892.1102 to help you get started. Todd is also the advisor for Mark and Jo Ann Skousen’s personal Indexed Annuity portfolio. Like I said, indexed upside participation rates are declining rapidly as insurers scramble to find yield in this new rate environment. Delaware life is still holding strong, but it won’t be long before they follow the pack and lower their rates, so don’t wait a second longer.

Defensive Strategy #2: Move a smaller portion of your “at risk money” into an Indexed Universal Life Insurance policy.

Why you may ask? Well for one, it has a life insurance benefit that will always be worth more than the deposits by multiples of 3 to 15 times. That way you can leave your family an inheritance, no matter how much you lose on your market investments, or how much you spend. Since medical underwriting is required for this Strategy, you need to jump on this as soon as today, since it will take a few weeks to get you approved. I would select a Max Funded version of the IUL, that way the cost of insurance will be at a minimum. If possible, I would base my deposit on a single sum Premium Deposit Account basis.

Once you decide on how much “at risk money” you would like to deposit, you should transfer an equal amount into a Money Market account while you await medical underwriting approval. Once you are approved you can transfer the Money Market funds into the Premium Deposit Account (PDA) of the policy, and then over 5, 7 or 10 years, have the company transfer an equal amount out each year to fund the policy. The policy would then be paid up and you will continue to earn interest on your cash value through the years that is based on the “upside only” performance of your selected Index Strategies.

One major carrier that we work with is currently paying 3.25% on their Premium Deposit Account and will guarantee that rate for the full 10 years! This carrier has a 96% Comdex rating and is over 100 years old. To know that you are going to earn 3.25% on your fixed account, with the Treasury paying less than 1% and the market imploding, those are reasons alone to jump all over this opportunity.

Let me give you an example:

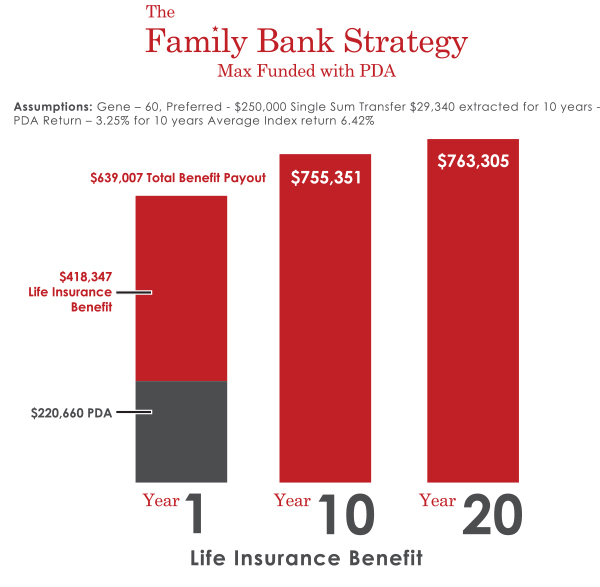

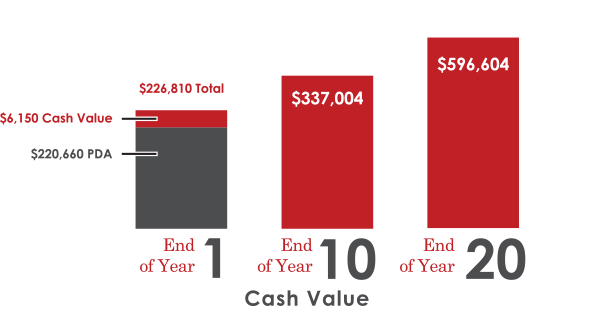

Gene, a 60 year old male, in good health, transfers $250k into the PDA and elects to deposit his scheduled premium for his IUL for 10 years from the PDA, or $29,340 each year. His immediate life insurance benefit will be $418,347, 14 times the first year premium, plus his family would also receive the balance of his PDA for a total payout $639,007 if death were to occur within the first year.

Through the years, Gene will earn interest on his cash value that will be tied to the upside only performance of one or more of the stock indexes. If the index goes down like it did last week, Gene WOULD NOT get to participate in any of the loss, in fact any gain that he will receive in the ensuing years, will be locked in and can’t be reduced to ashes like his current mutual fund and stock accounts.

In the 10th year Gene’s cash account will climb to $337,004 and his life insurance benefit will soar to $755,351. In the 20th year the cash would have increased to $596,404, assuming a doable average return of 6.42%.

You can’t get tickets to the 2020 Final Four, or even the Sweet 16, that’s an unfortunate fact. But I can guarantee, that if you move some of your “at risk money” today into either strategy or both, you will create “shelter from the storm” protecting your hard earned money from this terrible tempest we are facing.

Simply complete the Secure Retirement Account Analysis Request Form below and my staff will promptly call you to schedule a personal appointment with me or Todd. Since our firm has been offering the nation’s top financial products and services directly to our nationwide clientele since 1984, even before the internet, we are prepared to continue normal operations indefinitely.

“If”, as Mark Skousen admonished his subscribers, “you have money you can’t afford to lose. I suggest you move that money out of the stock market and into a Secure Retirement Account immediately.” We agree and are in the best position to make that happen for you, just like we have for the Skousen’s and many many more Americans.